Do you follow the conventional approach of buying risky assets for potentially higher returns? Well, this approach usually makes sense to most investors, but today we are here to show you how to build a strategy by doing the exact opposite of this. We call this strategy “Betting Against Beta”. This strategy is backed by research that suggests going against the crowd and buying low-beta assets could yield better returns.

We’ve backtested the strategy on 7 years of data of the S&P500 index and its constituents (500 stocks that fall under the index) and these were the results:

It is important to note that backtesting results do not guarantee future performance. The presented strategy results are intended solely for educational purposes and should not be interpreted as investment advice. A comprehensive evaluation of the strategy across multiple parameters is necessary to assess its effectiveness.

All the concepts covered in this post are taken from this Quantra course. You can preview the concepts taught in this post by clicking on the free preview button and going to Section 20-Unit 7 of the course.

What is Beta?

Beta is a measure of the stock’s sensitivity to overall market changes. In other words, it tells you how the stock may react in response to market changes.

- A beta of less than 1 means would mean that it's less volatile as compared to the market.

- A beta equal to 1 means the stock will move in the exact same manner as the market.

- A beta of more than 1 indicates that the stock is highly volatile.

Therefore, we can say that high-beta stocks are riskier than low-beta stocks. Since the risk is higher, it’s logical to assume that returns would also be higher.

But what if there was a strategy that challenges this conventional approach and offers a new perspective?

Let’s understand the Betting Against Beta (BAB) strategy.

Understanding the BAB Strategy

The BAB strategy, as outlined in a research paper, challenges the traditional belief that high-beta stocks are the way to go for higher returns. The paper suggests that constrained investors tend to bid up high-beta assets, leading to overvaluation and lower returns. On the other hand, low-beta assets tend to be neglected and undervalued, presenting an opportunity for investors.

What are the Trading Rules?

The BAB strategy involves going long on low-beta assets and shorting high-beta assets. This means buying assets with lower risk and short-selling assets with higher risk. By doing so, investors can potentially benefit from the mispricing of high and low-beta assets and generate positive risk-adjusted returns. To get a better understanding of this strategy you can take a free preview of Section 20, Unit 7 of this course.

Testing the Hypothesis

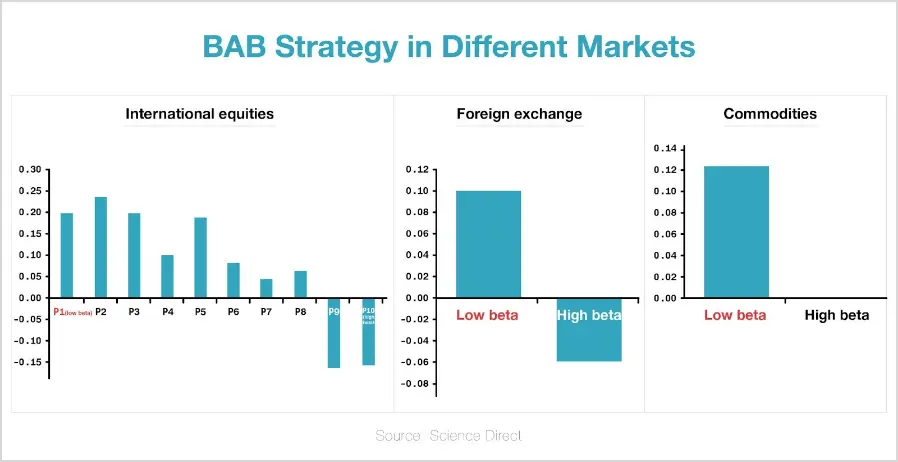

The research paper tested the BAB strategy not only with stocks but also across different asset classes, including commodities, foreign exchange, and international equities. The results consistently showed that as beta goes from low to high, returns tend to reduce.

This challenges the traditional belief that higher risk leads to higher returns and suggests that a contrarian approach of betting against beta could be more lucrative.

How did we confirm the strategy hypothesis?

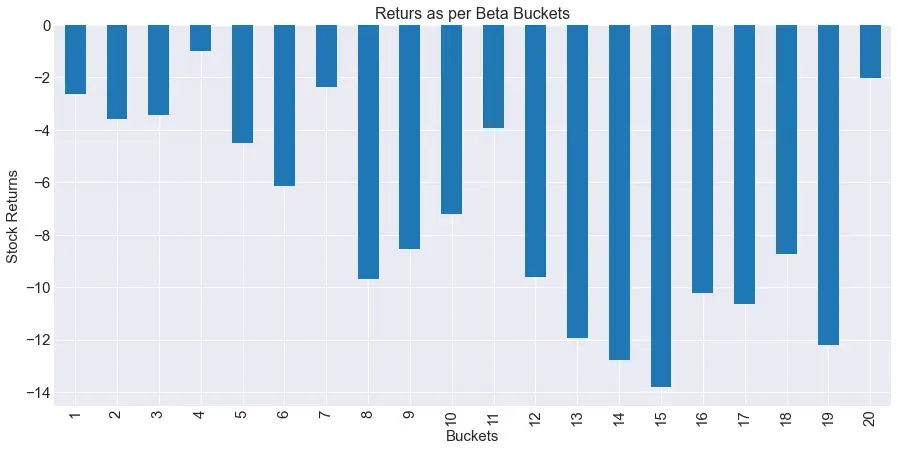

We started by calculating the beta of all the stocks, ranked them as per their beta, and divided the whole beta sample into 20 different buckets. Each bucket had approximately 25 stocks since we had 487 of them in total.

Bucket number '1' contained stocks that had the lowest betas and bucket number 20 contained the highest beta stocks. Finally, we computed the returns for each bucket. This is what it looks like:

As you can see, there's almost a downward slope from low to high-beta stocks. So, if we short sell the high-betas, as the paper suggests, we might be profitable.

Backtesting the strategy and creating signals

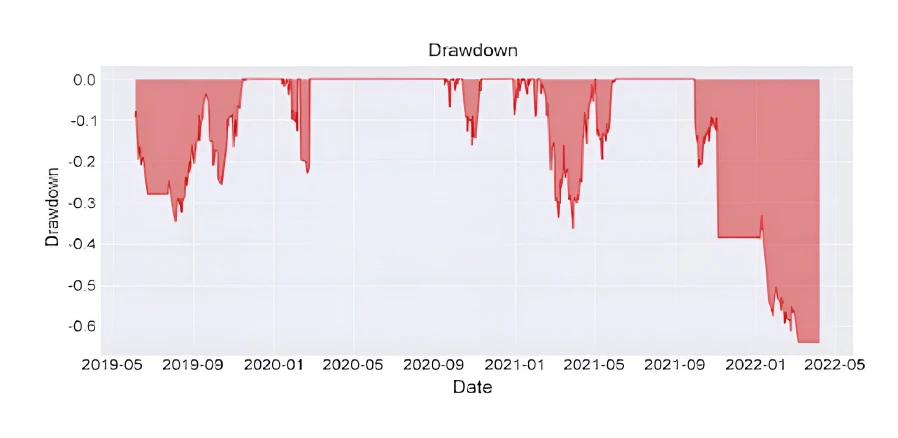

When we backtest the BAB strategy, the results look like this:

Note: During the backtested period, certain stocks were removed and certain stocks were added to the S&P500 list but we haven't considered that while backtesting our strategy. It is important to note that backtesting results do not guarantee future performance. The presented strategy results are intended solely for educational purposes and should not be interpreted as investment advice. A comprehensive evaluation of the strategy across multiple parameters is necessary to assess its effectiveness.

Conclusion

The research suggests that low-beta assets, which are often undervalued, may offer better risk-adjusted returns. However, like any investment strategy, the BAB strategy has its own risks and limitations and should be carefully evaluated before implementation.

As an investor, it's important to stay open to unconventional strategies and constantly challenge traditional beliefs to uncover new opportunities in the market. To explore more strategies such as this one, enroll to this course.