In options trading, predicting and capitalising on market volatility is crucial, especially around scheduled events like Federal Open Market Committee (FOMC) meetings. These events often lead to significant price movements, driven by market uncertainty and anticipation.

As traders, we can harness this volatility to our advantage. One of the strategies that can be deployed during such times is the long straddle. This strategy is a classic volatility play.

In this post, we will explore how to build a long straddle options strategy to trade the volatility around events. This course explores many such advanced options volatility concepts with practical applications and a special focus on risk management.

Note that backtesting results do not guarantee future performance. The presented results are intended solely for educational purposes and should not be interpreted as investment advice.

All the concepts covered here are taken from this course. You can preview the concepts taught in this post by going to Section 23 - Unit 11 of this course.

In this post, we will cover the following topics:

- What is a long straddle?

- Why Focus on Scheduled Events?

- Constructing the Long Straddle Strategy Around Events

- Backtesting the Strategy If you are new to options trading, check out our course ‘Options Trading Strategies In Python: Intermediate’.

Complexity level: Intermediate | Author: Akshay Choudhary

What is a Long Straddle?

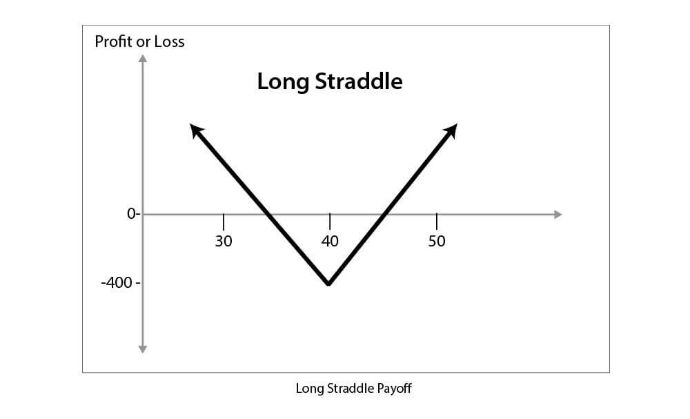

A long straddle is an options strategy that involves purchasing both a call option and a put option with the same strike price and expiration date. Typically, these options are bought at-the-money (ATM), meaning the strike price is close to the current price of the underlying asset..

The beauty of a long straddle lies in its nature as an implied volatility (IV) play. By holding both a call and a put option, you are positioned to profit from an increase in IV, regardless of the direction of the market movement. As IV rises, the value of both the call and put options increases, allowing you to profit as long as the market anticipates significant price movements. The key is the rise in volatility, regardless of the price direction.

Why Focus on Scheduled Events?

Market volatility often spikes around scheduled events like the FOMC meetings because of the uncertainty and anticipation they generate. Traders are often unsure about the outcomes of these events, leading to increased buying and selling activity. This heightened activity drives up implied volatility (IV), which in turn increases the value of both call and put options.

For example, let’s consider the FOMC meetings, which are closely watched by market participants. The Federal Reserve’s decisions on interest rates and monetary policy can have profound effects on the financial markets. In the days leading up to these meetings, traders typically become more cautious, hedging their positions and speculating on potential outcomes. This caution and speculation lead to a rise in IV, making the days before an FOMC meeting an ideal time to deploy a long straddle strategy.

Why Not Predict Event Outcomes?

One might wonder why we don’t attempt to predict the actual outcome of events like FOMC meetings. The answer lies in the unpredictability of market reactions. Even if you correctly anticipate the Fed’s decision, the market's reaction might not align with your expectations. For instance, the market might have already priced in a rate hike, and a seemingly "correct" prediction might lead to a muted market response.

Instead of trying to predict the outcome, the long straddle strategy focuses on profiting from the market's uncertainty. By entering the trade before the event and exiting before the outcome is announced, you sidestep the risk associated with trying to predict market direction and focus solely on capturing the volatility.

Constructing the Long Straddle Strategy Around Events

The effectiveness of a long straddle strategy hinges on two main factors: timing the entry and timing the exit. Both of these are crucial when dealing with event-driven volatility.

1. Timing the Entry: The entry point is critical because you want to enter the trade when IV is about to rise but hasn't peaked yet. If you enter too early, you might face time decay (theta), which erodes the value of your options. If you enter too late, you might miss the IV rush altogether.

For scheduled events like FOMC meetings, research and backtesting have shown that IV typically begins to increase around two weeks before the event. Therefore, entering a long straddle approximately 14 days before the event allows you to capture this pre-event volatility surge.

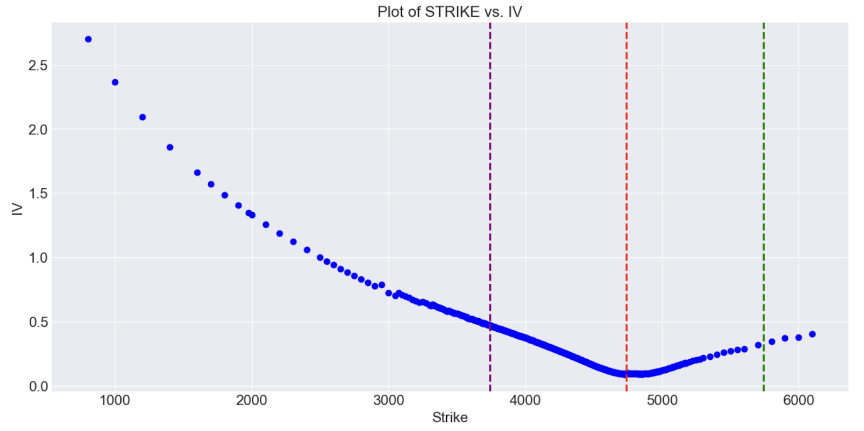

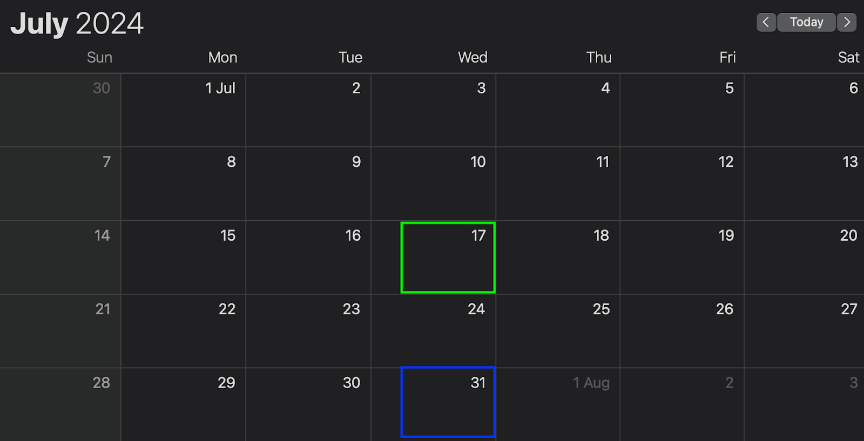

Figure: Long Straddle Entry

For instance, if an FOMC meeting is scheduled for July 31, you would set up your long straddle around July 17. At this point, you would purchase both an ATM call and an ATM put option with the same expiration date. The goal is to position yourself to benefit from the increase in IV as the market starts pricing in potential outcomes of the meeting.

2. Timing the Exit:

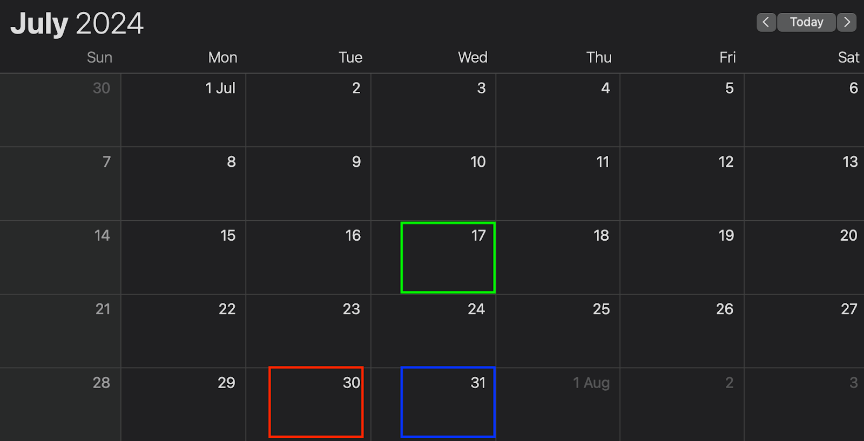

Exiting the trade is just as important as entering it. The day of the event is typically marked by high uncertainty, leading to a peak in IV. However, once the event passes, much of this uncertainty is resolved, and IV tends to drop sharply. This phenomenon, known as "volatility crush," can quickly erode the value of your options.

To avoid the impact of volatility crush, you can exit the trade one day before the event. Continuing with our example, if the FOMC meeting is on July 31, you would exit the long straddle on July 30. This timing allows you to capture the peak in IV without getting caught in the post-event volatility decline.

Figure: Long Straddle Exit

Backtesting the Strategy

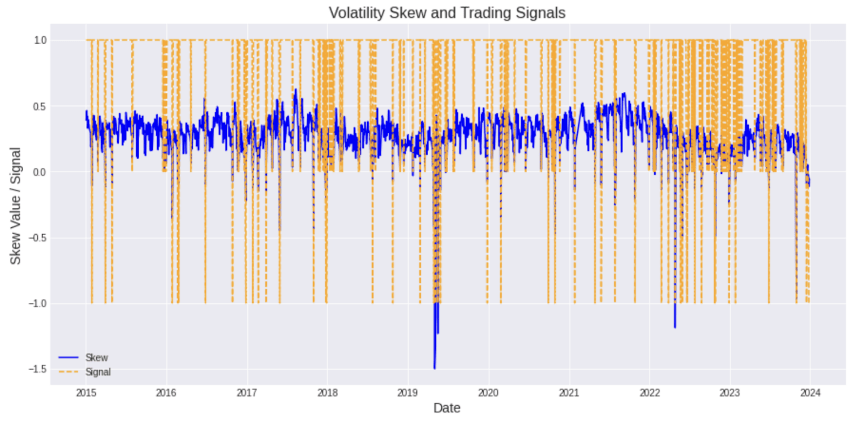

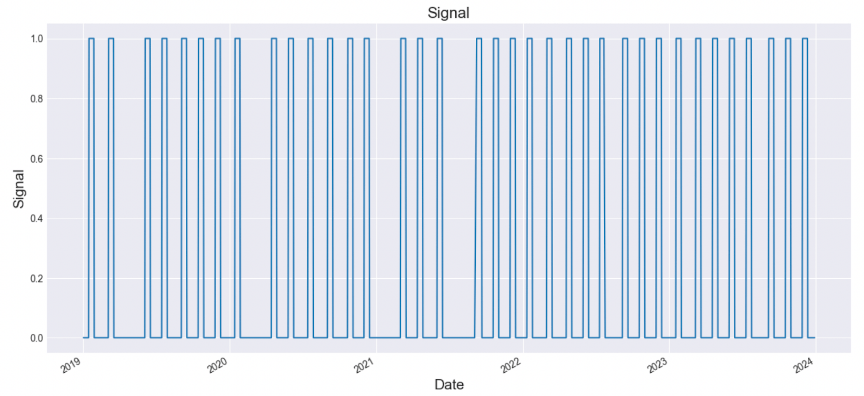

As with any trading strategy, backtesting is crucial to understanding how a long straddle might perform under different market conditions. By backtesting against historical data, particularly around previous FOMC meetings or other scheduled events, you can refine your entry and exit rules, optimise strike prices, and better understand potential risks and rewards.

In the above plot, when the signal is 1, deploy a long straddle, and when it is 0, exit the position.

The strategy discussed above has been covered in detail along with the Python code in this unit of the course.

Note that backtesting results do not guarantee future performance. The presented strategy is intended solely for educational purposes and should not be interpreted as investment advice.