Factor Investing: Concepts and Strategies

₹12500 /-₹49999/-

75% OFF

Get for ₹10000 with Course Bundle

- Skills Covered

- Learning Track

- Prerequisites

- Syllabus

- About author

- Testimonials

- Faqs

Skills Covered

Strategies

- Multi-factor strategy

- Factor-timing based strategy

- Value and momentum strategy

Concepts & Trading

- Factor Approach

- Smart Beta

- Ranking and Scoring Factors

- Combining Factors

Python

- Pandas

- Numpy

- Matplotlib

- Talib

Course Features

- Community

Faculty Support on Community

Interactive Coding Exercises

Interactive Coding ExercisesInteractive Coding Practice

Capstone Project

Capstone ProjectCapstone Project Using Real Market Data

- Get Certified

Get Certified

learning track 7

This course is a part of the Learning Track: Portfolio Management and Position Sizing using Quantitative Methods

Course Fees

Full Learning Track

These courses are specially curated to help you with end-to-end learning of the subject.

Prerequisites

To start with the course, you need to have a basic understanding of financial markets. You should also be familiar with some basic investment principles, including risk and return, portfolio, and asset allocation. A basic knowledge of Python, including pandas dataframe, matplotlib, and loops for strategy implementations (optional).

After this course you'll be able to

- Understand smart beta and list the advantages of factor investing

- Analyse the key factors such as value, momentum, size, and quality

- Quantify and evaluate different factors

- Create factor-based trading strategies

- Blend multiple factors in a cohesive manner to create portfolios with the potential for improved risk-adjusted returns

- Implement the factor timing technique

Syllabus

- IntroductionAn approach to investing that focuses on specific drivers of return across asset classes is factor investing. This section serves as a preview to the course and introduces the course contents. The interactive methods used in this course will assist you in not only understanding the concepts but also answering all questions about factor investing. This section explains the course structure as well as the various teaching tools used in the course, such as videos, quizzes, coding exercises, and the capstone projects.

Understanding Smart Beta

After completing this section you will be able to define Alpha and Beta. You will also be able to explain the concept of Smart Beta and its advantages over traditional index investing and active investing.Understanding Alpha and Beta3m 1sDefine Alpha5mIdentify Alpha5mNegative Alpha5mDefine Beta5mIndication of Beta5mBeta between 0 and 15mSmart Beta2mTraditional Index Investing5mActive Investing and Index Investing5mSmart Beta and Active Investing5mDescribe Smart Beta5mSmart Beta Advantages5mResearch Aspect of Smart Beta5mAdditional Reading on Smart Beta2mAll About Factors

In this section, you will learn about what factors are and how they influence the price of a security. Discover how factors lead to rewards and how the factor approach helps extract these rewards. In addition to this, you will also learn about all the ways that factor investing can be the right choice for you.Factor Premiums2mDefine Factors5mReason for Factor Premium Existence5mUses of factors5mPost Earnings Announcement Drift5mEarnings Announcement5mFactors and Asset Performance5mDefine Factor Premiums5mFactor Based Trading5mFactor Based Advantages2mBasis for Factor Approach5mPersistence in Factors5mFactors and Trading Rules5mCost of Factor-Based Approach5mRule-Based Approach5mLong-Term Persistence5mExistence of Factors5mFactors and Risk5mAdditional Reading on Factor Investing2m- Fundamental and Price DataAny strategy hypothesis requires data on which you can backtest and analyse the strategy performance. In this section, you will be able to retrieve the fundamental and price data of the top 100 U.S. stocks and build your stock universe which will be used later to create various factor-based strategies.Uninterrupted Learning Journey with Quantra2mFetching Fundamental Data5mCreating Stock Universe5mMarket Capitalisation5mFill the Missing Values5m

- Factor ApproachIn this section, you will go through the different types of factors which have been used by different investors and traders and also look at a few popular factors.Brief History of Factors2mIdentification of Factors by Fama French5mInitial Factors of Fama French Model5mDiscovery of New Factors5mTypes of Factors2mClassification of GDP5mPopular Style Factors5m

- What is Value?In this section, you will understand the core of the value factor and how it can be useful in your portfolio.What is Value?2mFactor and Low Price5mCommon Denominator Between New and Present Companies5mMeaning of Value for Money5mPerception of Value5mStock Selection5m

- Quantifying ValueYou have heard of the phrase, “value for money stock”. Or “the stock is undervalued”. In this section, you will try to identify the right fundamental ratio which can be used to objectively pick an undervalued stock from a given stock universe.Quantifying Value2mPoints of Consideration While Quantifying Value5mApplication of Earnings Per Share5mCalculation of P/E Ratio5mLow Value of P/E Ratio5mImportance of Financial Ratios5mImportance of P/E Ratio5mComparison of Stocks Based on P/E Ratio5mFinancial Ratios2mCalculation of Financial Ratios5m

Identification of Undervalued Stocks

Once you have identified the right metrics to identify an undervalued stock, you will begin the process of creating a value-based strategy by first identifying the top 10 undervalued stocks from our stock universe.Creation of Value Strategy2mObjective of Value Strategy5mIdentification of Undervalued Stocks Using PE Ratio5mUsing Two Ratios for Identification of Value5mTop Undervalued Stocks5mCombination of Financial Ratios5mPE Ratio and Value of a Stock5mPB Ratio and Value of Stock5mAverage Rank and Value of Stock5mStock Choice Based on Rank5mStrategy Flow Diagram2mIdentification of Undervalued Assets Using Financial Ratios5mCheck Start of Month of a DataFrame5mSelect First Day of Month5mRank Stocks in Ascending Order5m- Performance Analysis of Value Based StrategyIn this section, you will generate signals to go long on the top 10 undervalued stocks from our stock universe and analyse the performance of the value factor based strategy.Generation of Signals for Value Strategy5mRebalancing Portfolio5mPerformance Analysis of Value Strategy5mCAGR5mSharpe Ratio5mSummary2m

- Introduction to Absolute Valuation MethodIn the earlier sections, you focussed on relative valuation, where you compare different stocks based on a common metric. In this section, you will focus on the intrinsic value of a stock and assess if the stock is a good buy or not.What is Absolute Valuation2mDefinition of Value5mPurpose of Absolute Valuation5mValuation Method5mHow Does Absolute Valuation Work2mEssence of Valuation5mFormula of Absolute Valuation5mAddition to Absolute Valuation Formula5mRate of Return and Valuation Formula5mCaution of Absolute Valuation Formula5mStandardisation of Growth Rate5mDrawback of Absolute Valuation Formula5m

- Different Approach to ValueThe value based approach has been in existence for decades. But lately, a new approach to valuation has become popular, where you try to forecast the present value of the future earnings of a stock. You will understand the intuition behind this approach in this section. Further, you will also bust some myths around value factor based investing.Intuition of DCF Valuation Method2mDefinition of Cash Flow5mSteps in DCF Valuation Method5mCalculation of Present Value5mTerminal Value and DCF Valuation5mDCF Value Per Share5mUsage of Discount Rate in DCF Valuation5mDifference in Value Using DCF Valuation5mLimitation of DCF Valuation5mCalculation of Present Value of Next Five Years5mChoice of Asset Based on DCF5mSix Common Myths Of Value Investing3m 28sValue Investing Related Myths5mApplication of Value Investing Principles5mChallenges of Value Investing5mAdditional Reading2m

- Capstone Project - IIn this section, you will use the learnings from the value based strategy to create a unique strategy on your own.Getting Started2mProblem Statement2mCapstone Project - I Solution2m

- Momentum FactorIn this section, you will learn the reasons for the existence of momentum, namely, herding effect, slow diffusion of news, the persistence of roll returns in futures, forced sales and purchases by fund houses. This will give you an insight into where to find momentum and what causes it.Why Momentum Exists2mPrimary Assumption of Momentum5mHerding Effect Definition2mHerding Effect Towards Amazon2mReason for PEAD Effect2mMomentum in Futures2mReasons for Momentum2mEffect of Client Redemptions2mIndex Tracker Fund Performance2mTrading Momentum5mCharacteristics of Momentum2mMain Challenge with Persistence of Trends5mAvoiding Loss Due to Trend Reversal5mDefine a Momentum Crash5mDealing with Momentum Crashes5mStrength in Momentum5mStrong Momentum5mHolding Period5mAdditional Reading on Momentum Factor2m

Time Series Momentum

The time series momentum focuses on a security’s own past return. Learn the concepts of lookback and holding period. Backtest the time series momentum strategy and analyse the performance of this strategy.Types of Momentum2mIdentifying Winners2mWinner and Loser Ratio2mTime Series Momentum2mLookback and Holding Period2mTrading Decision Based on Returns2mEssential Points for Momentum Trading2mReason for Underperformance of Strategy2mStrategy Flow Diagram: Time Series Momentum2mTime Series Momentum Strategy5mCalculate Returns5mGenerate TSMOM Signals5mStrategy Flow Diagram: TSMOM with Volatility Adjusted Returns2mTSMOM with Volatility Adjusted Returns5mCalculate Volatility Adjusted Returns5mAlign Signal Index with Rebalanced Index5mAdditional Reading on Time Series Momentum2m- Live Trading on BlueshiftLearn how you can take your backtested strategy live with some important steps. Learn about the code structure, the various functions used to create a strategy, and finally, paper or live trade on Blueshift.Section Overview2m 19sLive Trading Overview2m 40sVectorised vs Event Driven2mProcess in Live Trading2mReal-Time Data Source2mBlueshift Code Structure2m 57sImportant API Methods10mSchedule Strategy Logic2mFetch Historical Data2mPlace Orders2mBacktest and Live Trade on Blueshift4m 5sAdditional Reading10mBlueshift Data FAQs10m

- Live Trading TemplateThis section includes a live trading strategy template. You can tweak the code by changing securities or the strategy parameters. You can also analyse the strategy's performance in more detail.FAQs for Live Trading on Blueshift5mPaper/Live Trading TSMOM Strategy2m

- Cross Sectional MomentumThe cross sectional momentum works on the relative performance of the securities. You will learn to find the optimal lookback and holding periods and the criterion to select stocks for cross sectional momentum strategy. Finally, create a cross sectional momentum strategy on S&P500 stocks and analyse the strategy's performance.Cross Sectional Momentum2mTypes of Momentum2mMomentum in Returns2mWhich Lookback and Holding Period?2mFactor to Filter Stocks?2mSteps for Cross Sectional Momentum Strategy2mWhich Fund House?2mImpact of High Number of Stocks2mLookback and Holding Period2mStrategy Flow Diagram: CSMOM2mCross Sectional Momentum Strategy10mCalculate Average Dollar Volume5mRank the Filtered Stocks5mGenerate Buy Signals5mCompute Trading Cost5mCalculate Lookback Returns With Skip Days5mMomentum Recap2m

Value and Momentum

Relying on momentum in all phases of the market may not be the right call. To create a well-rounded portfolio, you can try to blend other factors like value. This section explains how blending value and momentum factors can be the right fit for each other. After completing this section, you will be able to create an equally weighted portfolio consisting of two factors, i.e. value and momentum.Combining Value and Momentum2mWays to Combine Value and Momentum5mThe Upside of Combining Value and Momentum5mFiltering Stocks5mCombining Value and Momentum Factor5mMerging Dataframes5mCreate an Equally Weighted Portfolio5mAdditional Reading on Value and Momentum2mTest on Value and Momentum Factors16m- Size FactorIn this section, you will learn the reasons for the out-performance of small-cap companies and how to capture this outperformance.Size Factor: Definition and Intuition3m 48sDefinition of Size Factor5mOutperformance of Small-Caps5mLack of Attention5mTrading in Small-Cap Stocks5mEmma’s Dilemma5mCharacteristics of Size Factor2mCapturing the Size Factor5m

- Introduction to Quality FactorThe quality factor is quite popular among legendary investors like Warren Buffett, but is also the most confusing. In this section, you will unravel the basic tenets of selecting a quality stock.Part Overview2mPrerequisite for Quality Factor2mFactors Apart from Quality5mImportance of Financial Statements Analysis5mFinancial Statements and Corporate Governance5mCorporate Governance Checks2mHidden Losses5mArtificial Increase in Profitability5mIdentification of Suspicious Activities5mNeed of Independent Auditors5mChallenges in Identification of Fraudulent Companies5mSignificance of Reporting Expenses as Investments5m

- Creation of Quality StrategyIn this section, you will apply the principles of the quality factor to identify and go long on quality stocks.How to Identify Quality Stocks2mCommon Elements of Quality Stocks5mMeasurement of Company's Ability to Navigate Business Cycles5mEvaluation of Growth in Quality Stocks5mIdentifying Quality Stock Based on Growth5mCombination of Metrics for Quality Factor5mDifficulty of Identifying Quality Stocks5mIdentification of Profitability Element5mStrategy Flow Diagram of Quality Strategy2mCreation of Quality Strategy5mAdditional Reading2m

- Factor TimingDifferent factors perform differently across market phases and durations. This section discusses whether you can improve the performance of your strategy by considering the timing of individual factors and taking positions accordingly. It also uncovers some of the challenges you may face while adapting to this approach.Factor Timing2mDefine Factor Timing5mFactor Timing Approach5mTypes of Factor Timing5mTiming the Entry and Exit5mStrategy Flow Diagram: Factor Timing2mFactor Timing with RSI5mCalculate RSI5mRSI Strategy5mDrawbacks of Factor Timing2mChallenges of Factor Timing5mIncorrectly Timing Factors5mHigher Trading Frequency5mComplexity of Factor Timing5mMulti-Factor Approach5mAdditional Reading on Factor Timing2mFAQs on Factor Timing2m

- Identifying Relevant FactorsThis section covers the need to identify relevant factors to create a multi-factor portfolio. This section also covers the methods to screen the factors such as correlation analysis, robustness checks and performance filters.Need to Identify Relevant Factors2mRelevant Factors5mAim of Selecting Relevant Factors5mFactor Screening Methods5m 22sPurpose of Factor Screening5mPurpose of Correlation Analysis5mPurpose of Robustness Check5mFactor Screening with Correlation Analysis5mScreen Factors with Correlation Analysis5mThreshold for Correlation Analysis5mPerformance Filter and Robustness Check5mScreen Factors with Performance Filter5mScreen Factors with Robustness Check5mFAQs2mAdditional Reading for Identifying Relevant Factors2mSection Recap2m

- Capital Allocation To FactorsIn this section, you will learn to allocate capital to multiple factors. you will learn the drawbacks of using equal weightage method for capital allocation and explore ranking method for capital allocation.How to Allocate Capital to Different Factors?2mEqual-Weightage Approach5mDrawback of the Equal-Weightage5mHistorical Metrics for Capital Allocation5mRanking Method Based on Sharpe Ratios5mCapital Allocation Using the Ranking Method5mAssign Ranks Based on Sharpe Ratio5mAssumption of Ranking Method5mRanking Method With Single Historical Metric5mRank the Factors Based on the Sharpe Ratio5mSection Recap2mFAQ on Capital Allocation To Factors2m

- Ranking Method With Multiple MetricsIn this section, you will learn to calculate capital allocation for factors based on multiple historical metrics using the ranking method.Apply Ranking Method With Multiple Metrics2mRanking The Factors With Higher Volatility5mFormula to Calculate the Capital Allocation5mRanking Factors Using the Ranking Method5mPurpose of Assigning Ranks5mRanking Based on the Sharpe Ratio5mEfficient Method to Calculate Capital Allocation5mPurpose of Average Rank5mInverting the Ranking Logic5mCapital Allocation With Ranking Method5mCalculate the Historical Metrics5mRank the Cumulative Returns5mCode to Rank Based on Volatility5mDrawback of Ranking Method2mMain Drawback of Ranking Method5mOvercome the Drawback of the Ranking Method5mSection Recap2mFAQ on Ranking Method With Multiple Metrics2m

- Scoring Method for Capital AllocationIn this section, you will learn the scoring method for capital allocation and implementation of the same in Python. You will also learn how the scoring method overcomes the drawback of the ranking method.Scoring Method for Capital Allocation2mScoring Sharpe Ratio and Cumulative Returns5mRange of Historical Metric in Scoring Method5mUsing Volatility for Capital Allocation5mMin-Max Scaling Formula5mCalculation of Capital Allocation for Factors5mVolatility Inversion in Scoring Method5mBenefits of Min-Max Scaling5mCapital Allocation With Scoring Method5mScale the Factors Using the Minmax Scaler5mFormula of Capital Allocation With Scoring5mFAQs on Scoring Method for Capital Allocation2mAdditional Reading for Capital Allocation To Factors2mSection Recap2m

- Compare the Capital Allocation MethodsIn this section, you will learn the comparison between the capital allocation methods, ranking and scoring.Compare The Ranking and Scoring Methods2m 37sPrimary Drawback of the Ranking Method5mCalculate Scores for Factors5mScaled Historical Metrics for Capital Allocation5mDetermine Capital Allocation by Scoring Method5m

- Backtesting The Factor CombinationIn this section, you will learn to combine the factors to create a portfolio based on the screening and capital allocation techniques learned so far. In addition to this, you will also learn to rebalance the portfolio at regular intervals and study its performance.Strategy Flow Diagram2mBacktest Multi-Factor Portfolio Part-15mList to Store the Rebalancing Days5mStudy the Performance in Each Rebalance Cycle5mBacktest Multi-Factor Portfolio Part-25mBacktest the Multi-Factor Portfolio5mPerformance of the Multi-Factor Portfolio5mFAQs on Backtesting The Factor Combination2mAssessment Test14m

- Exploring Unknown FactorsDelve into uncharted territories by embarking on an exploration of unknown factors. Navigate through unexplored dimensions to uncover hidden insights and expand the boundaries of knowledge.Exploring Unknown Factors2mExistence of Unknown Factors5mMachine Learning Models5mSentiment Analysis5mTechnical Analysis5mResearch Papers5mPersonal Trading Experience5m

- Capstone Project - IIIn this section, you will use the learnings from the factor combination based strategy to create a unique strategy on your own.Getting Started2mProblem Statement2mCapstone Project - II Solution2m

- Live Trading on IBridgePyIn this section, you would go through the different processes and API methods to build your own trading strategy for the live markets, and take it live as well.Section Overview2m 2sLive Trading Overview2m 41sVectorised vs Event Driven2mProcess in Live Trading2mReal-Time Data Source2mCode Structure2m 15sAPI Methods10mSchedule Strategy Logic2mFetch Historical Data2mPlace Orders2mIBridgePy Course Link10mAdditional Reading10mFrequently Asked Questions10m

- Paper and Live TradingTo make sure that you can use your learning from the course in the live markets, a live trading template has been created which can be used to paper trade and analyse its performance. This template can be used as a starting point to create your very own unique trading strategy.Template Documentation10mTemplate Code File2m

- Run Codes Locally on Your MachineIn this section, you will learn to install the Python environment on your local machine. You will also learn about some common problems while installing python and how to troubleshoot them.Python Installation Overview1m 59sFlow Diagram10mInstall Anaconda on Windows10mInstall Anaconda on Mac10mKnow your Current Environment2mTroubleshooting Anaconda Installation Problems10mCreating a Python Environment10mChanging Environments2mQuantra Environment2mTroubleshooting Tips for Setting Up Environment10mHow to Run Files in Downloadable Section?10mTroubleshooting for Running Files in Downloadable Section10m

- SummaryIn this section, we will summarise all the concepts taught in the course. This section also consists of all the data and code files used in the course.Course Summary2mSummary and Next Steps2mPython Codes and Data2m

WEBINAR

Factor Investing with Algorithmic Trading

Registered Successfully!

You will receive webinar joining details on your registered email

Would you like to start learning immediately?

about author

Why quantra®?

- More in Less Time

Gain more in less time

- Expert Faculty

Get taught by practitioners

- Self-paced

Learn at your own pace

- Data & Strategy Models

Get data & strategy models to practice on your own

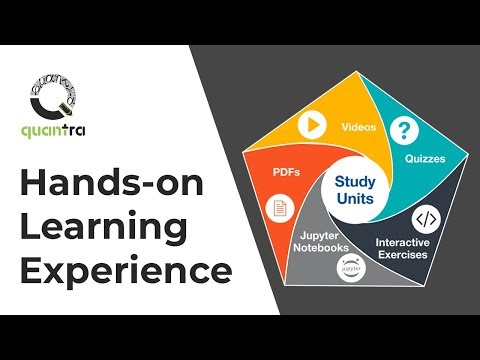

learning experience

Reviews

- 6000+5 Star Ratings

- 6400+Reviews from APAC Region

- 1700+Reviews from EMEA region

- 1500+Reviews from North & South America

Mayank Mittal

Mayank Mittal Technical Analyst,India

The course was no doubt good, the videos helped a lot, it's like you are in a classroom with the teachers teaching you. The MCQs are thought provoking, the answers may look simple at first, but once you start thinking, you know it is a smart question, something that will help you remember the answer for long!- Paul Gould

Australia

Great course and very helpful learning materials - Veera Raghunatha Reddy Naguru

United Kingdom

Great Course! - Johann Smith

Analyst at Phoenix Group,South Africa

Course was Insightful

Faqs

- When will I have access to the course content, including videos and strategies?

You will gain access to the entire course content including videos and strategies, as soon as you complete the payment and successfully enroll in the course.

- Will I get a certificate at the completion of the course?

Yes, you will be awarded with a certification from QuantInsti after successfully completing the online learning units.

- Are there any webinars, live or classroom sessions available in the course?

No, there are no live or classroom sessions in the course. You can ask your queries on community and get responses from fellow learners and faculty members.

- Is there any support available after I purchase the course?

Yes, you can ask your queries related to the course on the community: https://quantra.quantinsti.com/community

- What are the system requirements to do this course?

Fast-speed internet connection and a browser application are required for this course. For best experience, use Chrome.

- What is the admission criteria?

There is no admission criterion. You are recommended to go through the prerequisites section and be aware of skill sets gained and required to learn most from the course.

- Is there a refund available?

We respect your time, and hence, we offer concise but effective short-term courses created under professional guidance. We try to offer the most value within the shortest time. There are a few courses on Quantra which are free of cost. Please check the price of the course before enrolling in it. Once a purchase is made, we offer complete course content. For paid courses, we follow a 'no refund' policy.

- Is the course downloadable?

Some of the course material is downloadable such as Python notebooks with strategy codes. We also guide you how to use these codes on your own system to practice further.

- Can the python strategies provided in the course be immediately used for trading?

We focus on teaching these quantitative and machine learning techniques and how learners can use them for developing their own strategies. You may or may not be able to directly use them in your own system. Please do note that we are not advising or offering any trading/investment services. The strategies are used for learning & understanding purposes and we don't take any responsibility for the performance or any profit or losses that using these techniques results in.

- I want to develop my own algorithmic trading strategy. Can I use a Quantra course notebook for the same?

Quantra environment is a zero-installation solution to get beginners to start off with coding in Python. While learning you won't have to download or install anything! However, if you wish to later implement the learning on your system, you can definitely do that. All the notebooks in the Quantra portal are available for download at the end of each course and they can be run in the local system just the same as they run in the portal. The user can modify/tweak/rework all such code files as per his need. We encourage you to implement different concepts learnt from different learning tracks into your trading strategy to make it more suited to the real-world scenario.

- If I plug in the Quantra code to my trading system, am I sure to make money?

No. We provide you guidance on how to create strategy using different techniques and indicators, but no strategy is plug and play. A lot of effort is required to backtest any strategy, after which we fine-tune the strategy parameters and see the performance on paper trading before we finally implement the live execution of trades.

- What does "lifetime access" mean?

Lifetime access means that once you enroll in the course, you will have unlimited access to all course materials, including videos, resources, readings, and other learning materials for as long as the course remains available online. There are no time limits or expiration dates on your access, allowing you to learn at your own pace and revisit the content whenever you need it, even after you've completed the course. It's important to note that "lifetime" refers to the lifetime of the course itself—if the platform or course is discontinued for any reason, we will inform you in advance. This will allow you enough time to download or access any course materials you need for future use.

- What is a multi-factor strategy?

A multi-factor strategy, also known as multifactor investing, is an investment approach that involves combining multiple factors or characteristics to construct a portfolio. These factors are specific attributes or metrics of individual securities or assets that have historically been associated with higher returns or reduced risk. The goal of a multi-factor strategy is to create a diversified portfolio that goes beyond traditional market capitalization-weighted indices, with the aim of potentially achieving better risk-adjusted returns.

- How to use multi-factor strategies in portfolio construction?

Using multi-factor strategies in portfolio construction involves a systematic and deliberate approach to selecting and combining multiple factors. The steps include identifying relevant factors, setting portfolio objectives, selecting the investment universe, scoring and ranking assets based on each factor, determining factor weights, combining factors to calculate composite scores, constructing the portfolio, rebalancing regularly, and monitoring performance. Multi-factor strategies offer benefits like enhanced returns, diversification, risk reduction, and long-term consistency.

- What are the types of multiple factors?

Multiple factors, also known as factor categories or factor groups, are specific attributes or characteristics that investors consider when constructing multi-factor investment strategies. Common types of multiple factors include value, momentum, size, quality. There are also combinations of factors, such as quality & value, momentum & value and size & momentum.

- What is the advantage of a multi-factor strategy?

Multi-factor strategies offer several advantages, including enhanced returns by capturing a broader range of potential alpha sources, improved portfolio diversification, reduced exposure to specific risks, adherence to investment philosophy, flexibility, and customization, lower turnover and cost efficiency, long-term consistency, and empirical evidence supporting their potential to outperform traditional market-cap-weighted indices over time.

- What is a single-factor strategy vs a multi-factor strategy?

Single-factor strategies focus on one specific factor, such as value or momentum, to construct an investment portfolio. In contrast, multi-factor strategies combine multiple factors, such as value, momentum, size, quality, and others, to construct a more diversified portfolio. Single-factor strategies are simpler to implement, but they may be more exposed to specific risks associated with the chosen factor. Multi-factor strategies aim to provide a broader exposure to different sources of potential return and risk reduction by considering multiple factors simultaneously.