Explore the fascinating world of Hierarchical Risk Parity (HRP) - a technique that can revolutionize the way you manage your investment portfolio.

You know, when it comes to portfolio management, the weight you assign to each asset can significantly impact your overall returns. But have you ever wondered if a machine-learning algorithm could help with this?

Well, the answer is yes - that's where HRP, an unsupervised machine learning algorithm, comes into play!

Now, let's break it down a bit. Hierarchical Risk Parity is a highly advanced approach to portfolio allocation. It takes advantage of Hierarchical Clustering, a powerful technique that groups similar assets based on their characteristics. By doing so, HRP intelligently optimizes the weight allocation of these asset groups according to their risk profiles.

So, if you're looking to take your investment portfolio to the next level, HRP might just be the solution you've been searching for!

All the concepts covered in this tutorial are taken from this Quantra course. You can preview the concepts taught in this course by clicking on the free preview button.

Portfolio Allocation

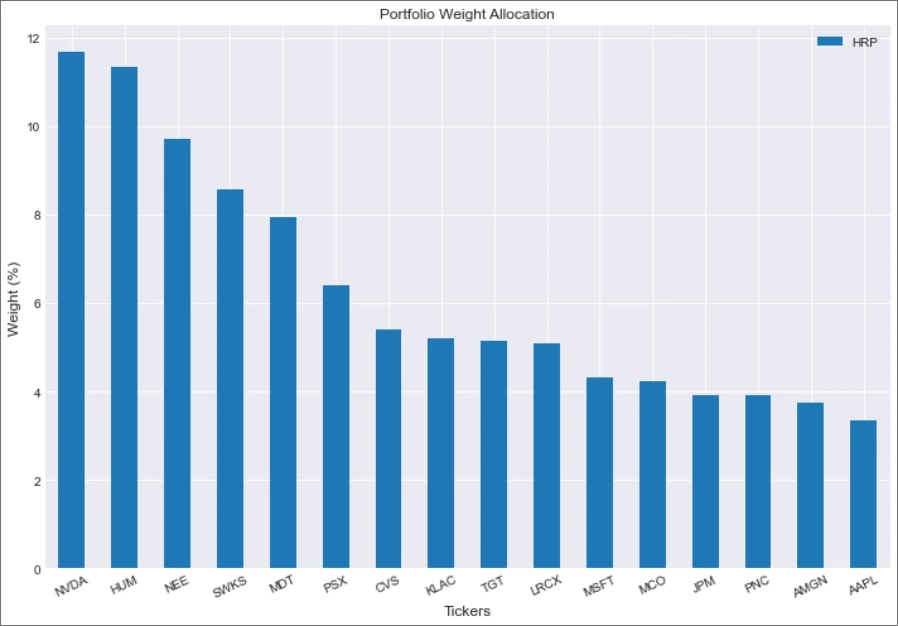

We took a sample data of 16 stocks and ran it through the HRP algorithm - a machine learning (ML) technique. The weights that were assigned to each of the stocks are shown below:

For a 21-month period, the portfolio had been assigned weights by the ML model. It is important to note that backtesting results do not guarantee future performance. The presented strategy results are intended solely for educational purposes and should not be interpreted as investment advice. A comprehensive evaluation of the strategy across multiple parameters is necessary to assess its effectiveness.

The steps for carrying out portfolio allocation using HRP are covered in this course. You can take a free preview to learn more about this.

Hierarchical Clustering

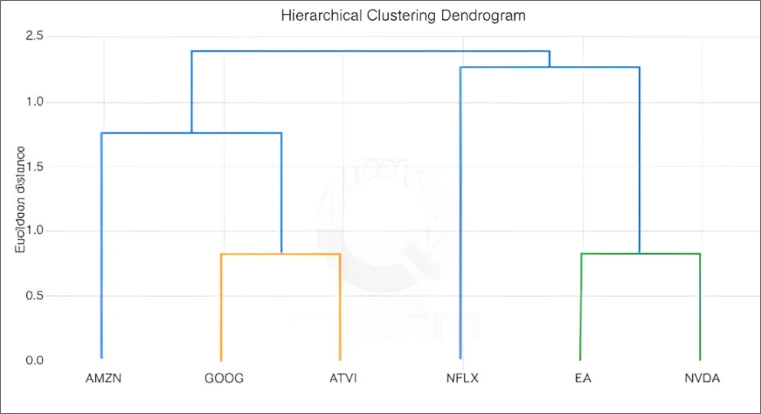

To fully grasp the concept of HRP, let's take a quick detour into Hierarchical Clustering. Imagine you have a list of stocks, each with unique characteristics and performance patterns. Hierarchical Clustering allows us to group these stocks based on their similarities, forming clusters or portfolios that share common traits. Think of it as creating a family tree for stocks, where we establish relationships between them and identify clusters of similar assets.

The Role of the Inverse Volatility Approach

Now, here comes the star player - the Inverse Volatility Approach! HRP combines the insights from Hierarchical Clustering with this smart technique. The Inverse Volatility Approach involves allocating a smaller portion of your investment to riskier assets and a larger portion to assets with lower risk. It's like having a risk management superhero on your side!

Implementing Hierarchical Risk Parity

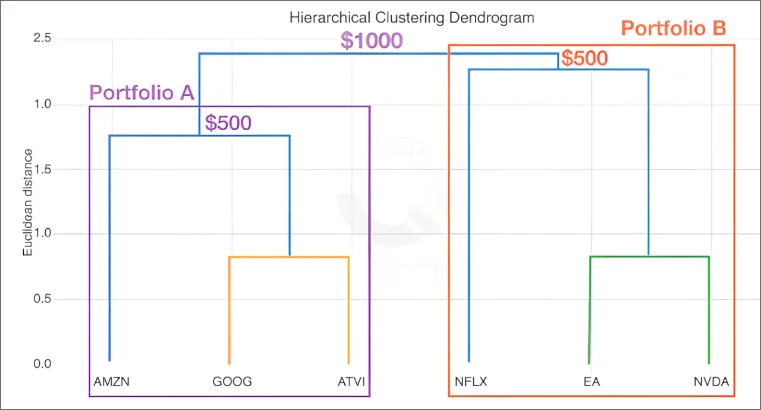

Imagine you have a thousand dollars and want to invest it wisely in a set of stocks. To do this, you need to divide the dendrogram, which represents the relationships among these stocks, into two groups or portfolios. Let's call them Portfolio A and Portfolio B.

One common approach would be to allocate equal amounts to both portfolios. However, we've already learned that this can be a naive method, and there are better techniques at our disposal.

What’s a smarter approach for portfolio allocation? The inverse volatility approach! You've studied this technique earlier, and it involves allocating a smaller amount to a risky portfolio and a higher amount to a portfolio with relatively lesser risk. A smart way to optimize your investments, right?

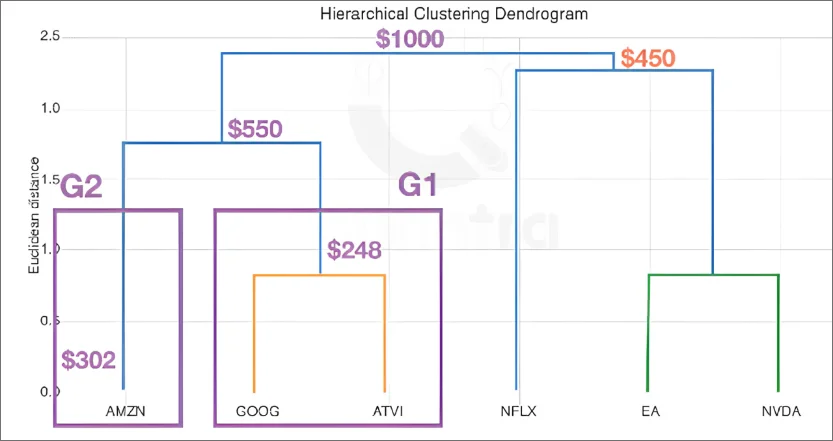

Let's put this into action! After calculating the standard deviation of Portfolio A and Portfolio B, we find that Portfolio A has a standard deviation of 40% and Portfolio B has a standard deviation of 50%. Hence, the corresponding weights come out as 55% or 550 dollars to Portfolio A, and 45% or 450 dollars to Portfolio B.

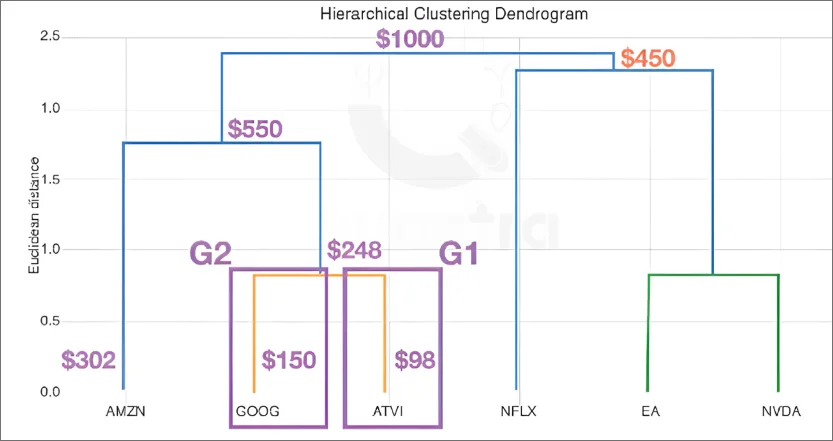

Now, we take it a step further and divide the $550 among the three stocks in Portfolio A: Google, Amazon, and Activision Blizzard. We follow the same approach here and assign weights based on standard deviation. By creating two separate groups as per the dendrogram, we find that $248 goes to Group 1 (consisting of Google and Activision Blizzard) and the remaining $302 to Amazon in Group 2.

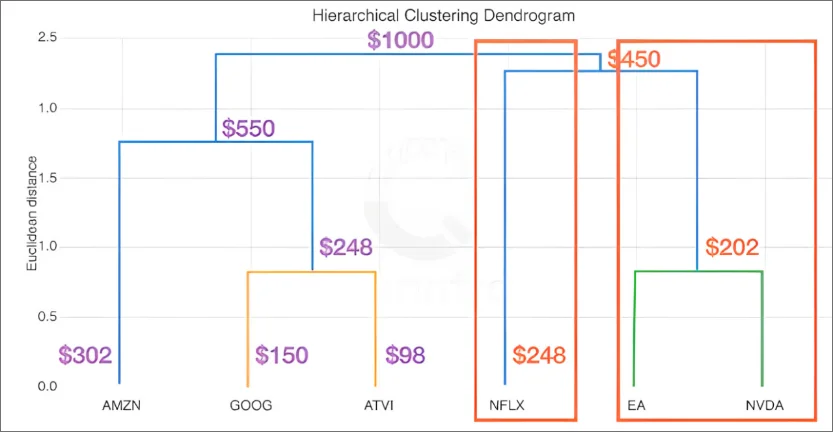

Next up, we allocate within the groups. As per the inverse volatility method, approximately 60% (or $150) goes to Google, and the rest, $98, goes to Activision Blizzard.

By repeating this process for Portfolio B, we've successfully allocated weights to each stock based on the dendrogram and the inverse volatility approach. This powerful combination is what we term Hierarchical Risk Parity (HRP).

It is important to note that backtesting results do not guarantee future performance. The presented strategy results are intended solely for educational purposes and should not be interpreted as investment advice. A comprehensive evaluation of the strategy across multiple parameters is necessary to assess its effectiveness.

Conclusion

Congratulations! You've now learned how to allocate weights to stocks like a pro using Hierarchical Risk Parity. This technique optimizes your investments, minimizes risks, and maximizes returns. With HRP, you can confidently navigate the complex world of finance, making smarter investment decisions along the way. To learn more about how to implement this method using Python, head to the course!