Volatility is the measure of risk in the options market. However, volatility is more than just a risk factor; it's a trading opportunity waiting to be seized. In this blog, we'll unravel the concepts of the variance premium, such as what is variance premium is, why the variance premium exists and how to trade it.

Let us cover the concept of volatility premium, which is one of the essentials in volatility trading.

All the concepts covered in this post are taken from section 17 unit 1, and unit 10 of this Quantra course. You can preview the concepts taught in this course by clicking on the free preview button.

What is the Volatility Premium?

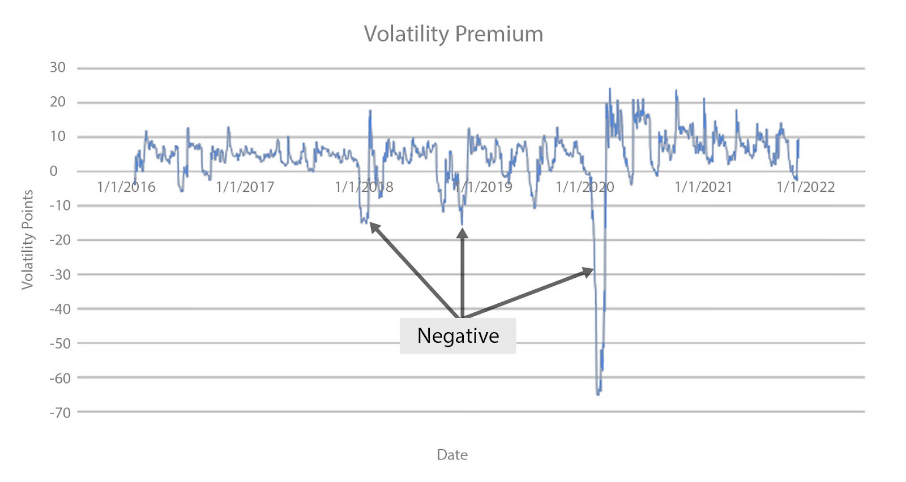

The volatility premium (also known as variance premium) is the difference between implied volatility (expectation) and realised volatility (actual). If implied volatility is higher than realized volatility, there is said to be a positive variance premium. Conversely, if implied volatility is lower than realized volatility, there is a negative variance premium.

At its core, the variance premium signifies that options are typically overvalued in the market. It is a phenomenon where the implied volatility (expectation) of options tends to be higher than the subsequent realized volatility (actual). In simpler terms, there's a trading opportunity by selling options without engaging in complex strategies.

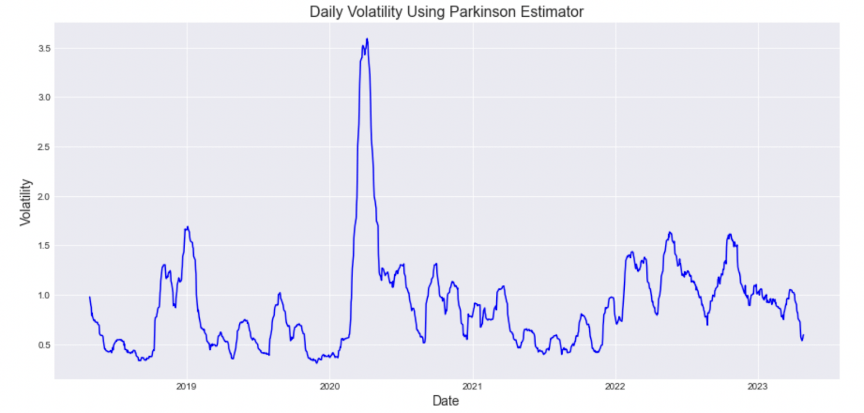

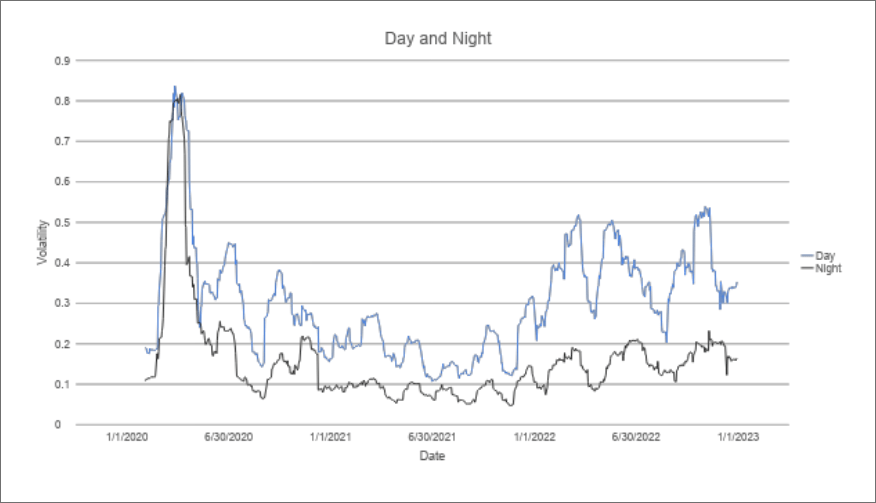

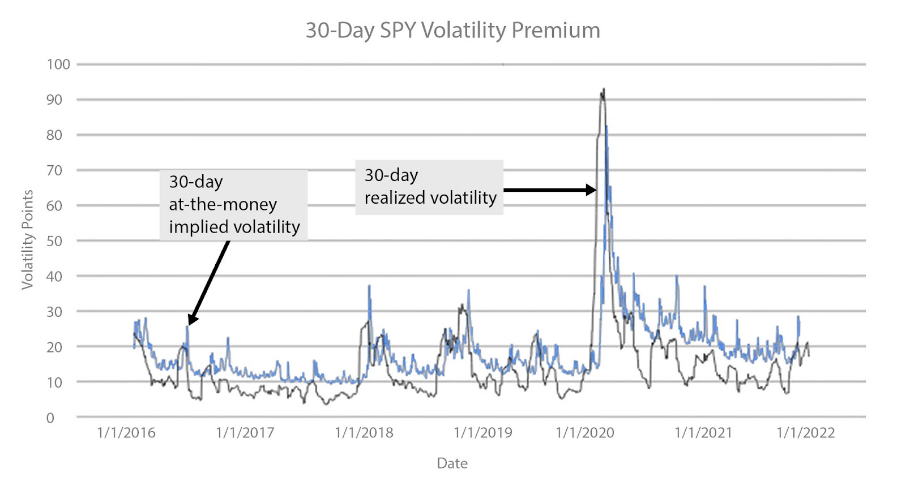

The 30-day at-the-money implied volatility is in blue, and the subsequent 30-day realised volatility is in black. You can see that implied volatility is higher than the realised volatility a majority of the time.

However, the volatility premium can be positive or negative as shown in the above plot. It should be noted that the variance premium exists even at low levels of volatility.

Why does the Variance Premium exist?

Asymmetry of Options Profits:

The variance premium is driven by the inherent asymmetry in potential option profits. When individuals are presented with a trade that, on average, results in no loss but offers the potential for substantial gains, they are inclined to take such opportunities. Option sellers recognize this preference for asymmetric returns and seek compensation for undertaking the associated risks.

Options as Insurance:

Another contributing factor is the role of options as a form of insurance. Analogous to how insurance companies charge a premium for providing coverage, option sellers demand compensation for offering a financial instrument that serves as a hedge against adverse market movements. This compensation contributes to the presence of the variance premium.

Perception of Extreme Events (Black Swans):

The variance premium is influenced by human psychology, particularly the tendency to vividly remember extreme events or "black swans." The options market, especially for far out-of-the-money puts, tends to overestimate the probability of such unexpected events. While these extreme events do occur, their frequency is lower than what the options market reflects, contributing to the establishment of the variance premium.

In summary, the variance premium is a result of the interplay between the asymmetric nature of potential option profits, the risk-mitigating role of options, the human tendency to overvalue extreme events, and its widespread presence across various options and financial instruments. The unobservability until the future unfolds adds a layer of complexity, but traders can navigate this landscape by understanding and leveraging the inherent characteristics of the variance premium.

How to trade Variance Premium?

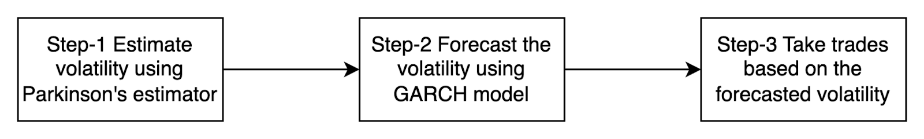

Trading the variance premium involves capitalising on the tendency of implied volatility to be higher than subsequent realized volatility in the options market.

Selling options is a common strategy for harvesting the variance premium. When traders sell options, they are essentially capitalising on the overestimation of future volatility, thus collecting the premium associated with those options.

For example, sell a straddle by simultaneously selling a put and a call option with the same strike price and expiration date. This strategy profits from high implied volatility as the market tends to overestimate the potential price movement.

Similarly, you can sell a strangle with different strike prices for the put and call options. This strategy is effective when there is an expectation of moderate price movement, and the market overvalues potential extremes.

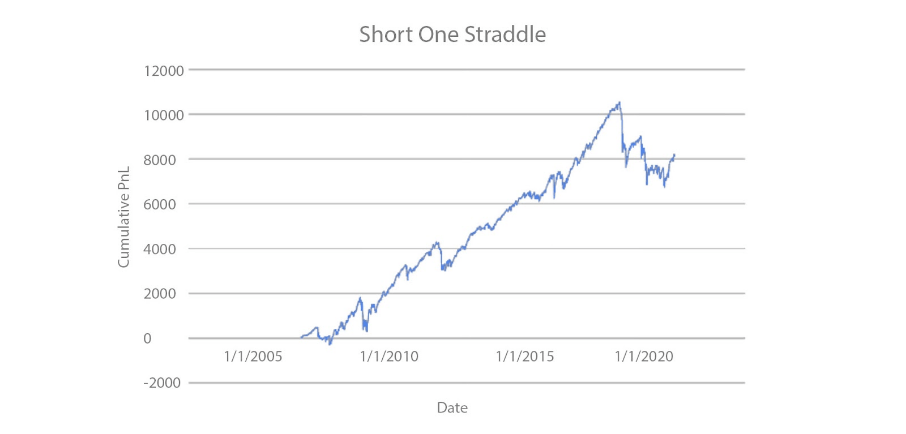

Here we see the results of selling a SPY straddle, specifically the straddle that expires closest to 30 days from the trade date. Each Friday, we close the position, open a new one with 30 days to expiration, and strike at the new stock price.

Obviously, this strategy has suffered in the last few years, but we can also see its long-term success.

There are many ways to improve this strategy. We could add filters based on a realised volatility forecast, the VIX level, the VIX term structure, or the volatility of the VIX.

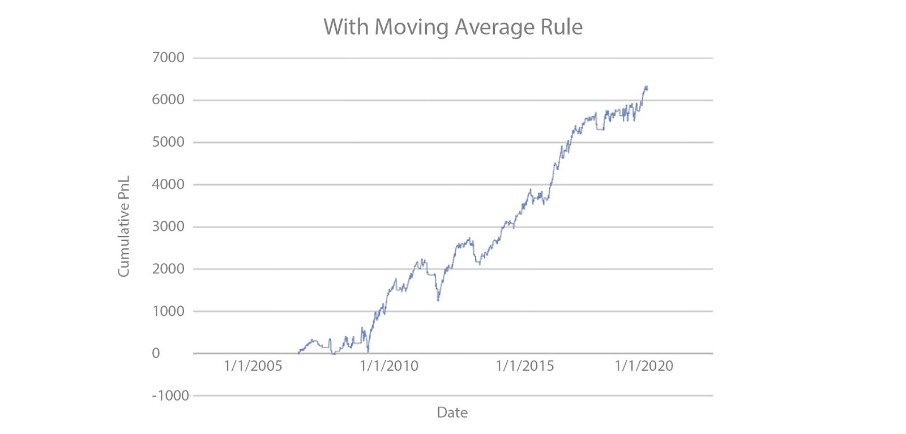

For example, the straddles can only be sold when the VIX is below a rolling moving average. This is a simple way to take advantage of the volatility clustering effect. We know that volatility tends to cluster, so there is no hurry to get short, and we can wait for VIX to fall instead of selling as it spikes.

The modified strategy with the moving average rule actually gives us steady results.

To know more about developing and backtesting trading strategies to trade the variance premium, check out the section How to Trade Variance Premium.