Options Trading Strategies In Python: Basic

- Skills Covered

- Learning Track

- Prerequisites

- Syllabus

- About author

- Testimonials

- Faqs

Skills for Options Trading using Python

Course Features

- Community

Faculty Support on Community

Interactive Coding Exercises

Interactive Coding ExercisesInteractive Coding Practice

- Get Certified

Get Certified

learning track 3

This course is a part of the Learning Track: Quantitative Trading in Futures and Options Markets

Full Learning Track

These courses are specially curated to help you with end-to-end learning of the subject.

At QuantInsti, our mission is to make algorithmic trading knowledge and technology accessible to everyone. Our vision is to empower individuals and institutions, enabling them to harness cutting-edge technology in financial markets, fostering growth and success. We offer comprehensive learning tracks, free fintech tools, hundreds of engaging webinars, and a vast repository of over 500 insightful blogs designed to equip aspiring traders with essential skills and resources.

For over 14 years, we've actively contributed as speakers and industry experts at academic and professional forums globally, helping shape the future of algorithmic trading. This free course exemplifies our commitment to accessibility and empowerment, helping you take your first step into the ever-evolving world of algorithmic trading. We appreciate you joining us on this exciting journey. Happy Learning!

Prerequisites for Option Trading Strategy Course

You can do this course even if you have no knowledge of Options and Derivatives. No experience in Python programming is required to learn the core concepts and techniques related to Options trading. If you want to be able to code and implement the techniques in Python, experience in working with 'Dataframes' and 'Matplotlib' is required. These skills are covered in the 'Python for Trading' course.

After this course you’ll be able to

Calculate Option payoff and check for Put-Call Parity

Compute Historical Volatility of Options

Create a trading strategy on Options using Bull-Call, Bear-Put, Protective Call, Protective Put and Iron Condor

Options Trading Strategy Course

- Know Your Options!This section introduces the basic concepts of call and put options, along with the Python code payoff graphs.IntroductionQuantra Features and GuidanceOptions TerminologyUpfront PaymentOptions PricePut OptionsPnL of a Put OptionBreak Even PointHow to Use Jupyter Notebook?Put Option PayoffPut Option PayoffCall OptionsValue of a Call OptionPnL of a Call OptionCall Option PayoffCall Option PayoffCall Option Payoff With PremiumTest on Options Types and Terms

- Options Nomenclature

- Types of Volatility

- Options Trading Strategies

- Run Codes Locally on Your Machine

- Wrapping Up!

Why quantra®?

- More in Less Time

Gain more in less time

- Expert Faculty

Get taught by practitioners

- Self-paced

Learn at your own pace

- Data & Strategy Models

Get data & strategy models to practice on your own

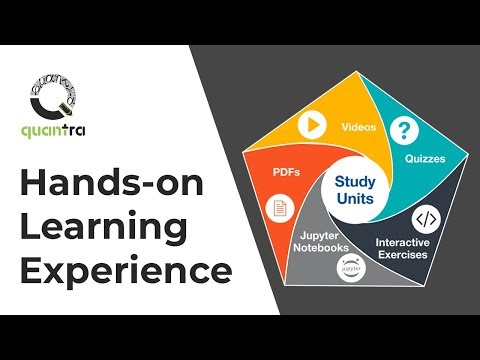

learning experience

Faqs

- When will I have access to the course content, including videos and strategies?

You will gain access to the entire course content including videos and strategies, as soon as you complete the payment and successfully enroll in the course.

- Will I get a certificate at the completion of the course?

- Are there any webinars, live or classroom sessions available in the course?

- Is there any support available after I purchase the course?

- What are the system requirements to do this course?

- What is the admission criteria?

- Is there a refund available?

- Is the course downloadable?

- Can the python strategies provided in the course be immediately used for trading?

- I want to develop my own algorithmic trading strategy. Can I use a Quantra course notebook for the same?

- If I plug in the Quantra code to my trading system, am I sure to make money?

- Will I be able to deploy Options Trading Strategies in the live market?

- What does "lifetime access" mean?