Straddle

Straddle is an options trading strategy in which the investor holds a position in both a call and a put with the same underlying price having the same strike price and expiration date.

A straddle is used when we expect the stock price to move significantly regardless of the direction of the move, basically with an expectation of high volatility.

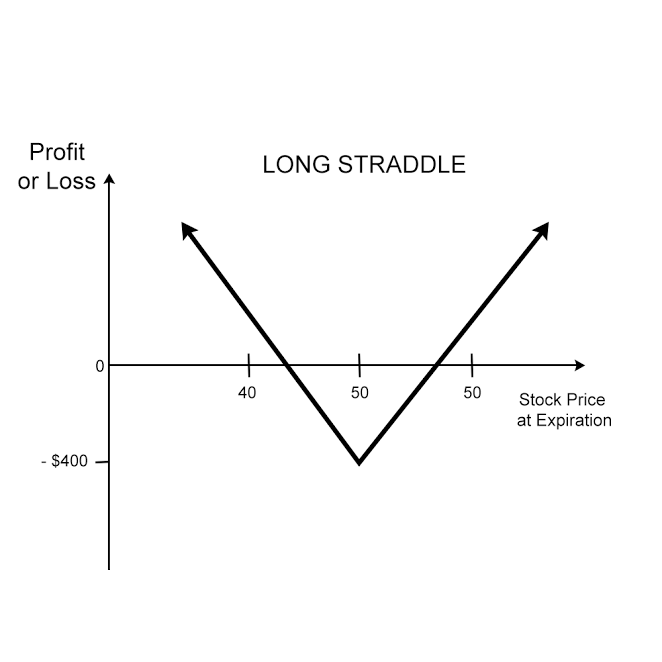

Long Straddle - In a long straddle, profit is unlimited and loss is limited.

Buy 1 ATM call

Buy 1 ATM put

Suppose a stock is trading at $50. An options trader enters a long straddle by buying a $50 strike put for $200 and a $50 strike call for $200. Then the net debit to enter the trade is $400, which is also his maximum possible loss.

Case 1:

If the price of the underlying goes up, then the call is in the money and the put expires worthless. Hence the net profit is the net premium paid minus the profit from the long call.

Case 2:

If the price of the underlying goes below, then the put is in the money and the call expires worthless. Hence the net profit is the net premium paid minus the profit from the long put.

Case 3:

If the price of the underlying remains the same at expiration, both options expire worthless and the net loss is the premium paid to enter the trade, which is also the maximum loss for the strategy.

Short Straddle - In a short straddle, profit is limited but the maximum loss is unlimited.

Sell 1 ATM call

Sell 1 ATM put

Suppose a stock is trading at $50. An options trader enters a short straddle by selling put and call at a strike price of $40 for $200, assuming a lot size of 100. The net credit from the trade is $400.

Case 1:

On expiration, if the stock is still at $50, both the options expire worthless and the net profit is the initial credit of $400 which is his maximum profit.

Case 2:

Suppose XYZ goes up to $60, the put expires worthless but the call is in the money and has an intrinsic value of $1000. Subtracting the initial credit of $400, the trader’s loss comes to $600. If stock moves significantly then the losses can be unlimited.